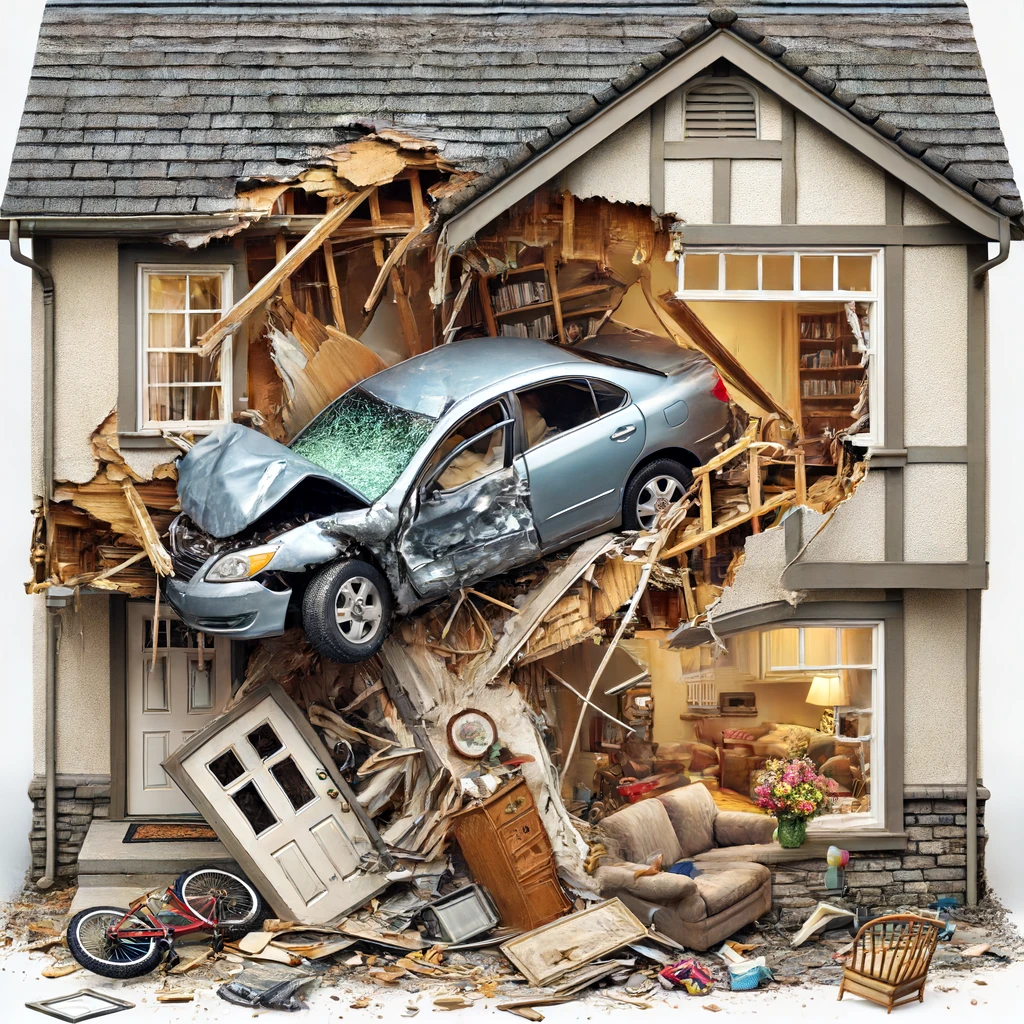

If you crashed your car into a house, which kind of insurance would you use?

What happens if a car crashes into your house?

Imagine this: you’re driving home after a long day, maybe your favorite song is on the radio, and your mind wanders for just a second. Suddenly, you lose control, and before you know it, you’ve accidentally crashed your car into someone’s house. It sounds like something out of a movie, but these things can happen in real life. So, what kind of insurance do you need in this scenario? Let’s break it down in detail.

Understanding Your Coverage

First things first, it’s crucial to understand the different types of car insurance coverage. When it comes to a situation where you’ve crashed your car into a house, two main types of insurance come into play: auto insurance and homeowner’s insurance.

Auto Insurance: Your First Line of Defense

Auto insurance typically consists of several different types of coverage, each designed to protect you in different situations. Here’s a closer look at the coverages relevant to our scenario:

Liability Coverage: This is the primary coverage that kicks in when you cause damage to someone else’s property with your vehicle. If you crash your car into a house, your liability insurance will cover the damage to the house, up to the limits of your policy. Liability coverage is divided into two parts:

- Property Damage Liability (PDL): This covers the cost of repairing or replacing the house or any other property you damage.

- Bodily Injury Liability (BIL): If anyone in the house is injured due to the crash, this part of your liability insurance helps cover their medical expenses, lost wages, and even legal fees if you’re sued.

Collision Coverage: While liability covers the damage to the house, collision coverage is what you’ll need to repair your car. Collision insurance covers the cost of repairs to your vehicle, regardless of who is at fault. This means that even if the accident was entirely your fault, collision coverage will help pay for the repairs or replacement of your car.

It’s important to note that collision coverage comes with a deductible, which is the amount you have to pay out of pocket before your insurance kicks in. Deductibles can vary, so make sure you know what yours is.

Homeowner’s Insurance: A Safety Net for the Homeowner

On the other side of the fence, the homeowner’s insurance policy of the house owner also plays a role. Homeowner’s insurance typically covers the repairs to the home itself. However, in most cases, the homeowner’s insurance will pursue your auto insurance company for reimbursement through a process called subrogation.

Homeowner’s insurance usually includes:

- Dwelling Coverage: This part of the policy pays for repairs to the structure of the home. So if your car damaged the walls, foundation, or any other part of the house, dwelling coverage would handle it.

- Personal Property Coverage: If any personal belongings inside the house were damaged due to the crash, this coverage would pay to repair or replace them.

The Role of Personal Injury Protection (PI best online pharmacy with fast delivery buy furosemide online with the lowest prices today in the USA

P)

If you or any passengers in your car were injured in the crash, Personal Injury Protection (PIP) or Medical Payments Coverage (MedPay) can help cover medical expenses. PIP is mandatory in some states and optional in others, but it’s incredibly beneficial as it covers medical costs for you and your passengers, regardless of who was at fault. This can include:

- Medical Bills: Doctor visits, hospital stays, surgeries, and other medical treatments.

- Lost Wages: If your injuries prevent you from working, PIP can compensate you for your lost income.

- Funeral Expenses: In the tragic event of a fatality, PIP can help cover funeral costs.

What If You Don’t Have Enough Coverage?

Now, what if the damage exceeds your insurance limits? This is where having sufficient insurance coverage becomes critical. If the damages to the house and your car exceed your policy limits, you could be held personally responsible for the remaining costs. In such cases, you might need to pay out of pocket or even face legal action from the homeowner to recover the additional costs.

Umbrella Insurance: Extra Protection

To avoid the risk of insufficient coverage, you might consider umbrella insurance. Umbrella insurance provides additional liability coverage beyond the limits of your standard auto and homeowner’s policies. It kicks in when your regular policy limits are exhausted, offering extra protection against major claims and lawsuits.

Conclusion: Be Prepared and Stay Covered

So, if you ever find yourself in the unfortunate situation of crashing your car into a house, your auto insurance, particularly liability and collision coverage, will be your primary protection. Ensuring you have adequate coverage limits is essential to avoid significant financial strain. Additionally, understanding how your homeowner’s insurance interacts with auto insurance can help clarify the claims process and ensure all damages are covered.

In essence, the best way to protect yourself is by having comprehensive and sufficient insurance coverage. Review your policy limits regularly, consider higher coverage amounts, and consult with your insurance agent to ensure you’re fully protected against all potential risks, including those unexpected movie-like scenarios.

FAQ

Can you claim insurance if it was your fault?

Yes, you can claim insurance if it was your fault, but the type of coverage you have will determine what expenses are covered. Liability insurance covers damages to others’ property and injuries if you are at fault, but it does not cover your own damages. For your own vehicle’s damages, collision coverage would be necessary. This type of coverage pays for the repair or replacement of your car regardless of who is at fault.

What is full coverage insurance in California?

Full coverage insurance in California typically refers to a combination of different types of coverage to protect you in various scenarios. It generally includes:

- Liability insurance: Covers bodily injury and property damage to others when you are at fault.

- Collision insurance: Covers damages to your car from a collision, regardless of fault.

- Comprehensive insurance: Covers damages to your car from non-collision events, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured motorist coverage: Protects you if you’re in an accident with someone who doesn’t have sufficient insurance.

- Medical payments coverage: Helps pay for medical expenses for you and your passengers after an accident.

What happens if someone who isn’t on your insurance crashes your car in California?

If someone who isn’t on your insurance crashes your car in California, several factors come into play:

- Permissive Use: If you gave them permission to drive your car, your insurance will typically cover the damages under your policy.

- Excluded Drivers: If the person is specifically excluded from your policy, your insurance will not cover the damages.

- Policy Terms: Check your policy for specific terms regarding who is co best online pharmacy with fast delivery buy celexa online with the lowest prices today in the USAvered when driving your vehicle.

In any case, it’s important to report the incident to your insurance company and provide accurate details to ensure proper handling of the claim.

What is the most common bodily injury coverage?

The most common bodily injury coverage is Bodily Injury Liability (BIL). This coverage is required by law in most states and typically includes:

- Coverage Limits: Policies usually have two limits – one for each person injured in an accident and another for the total injuries per accident.

- Per Person Limit: The maximum amount the insurer will pay for one person’s injuries.

- Per Accident Limit: The maximum amount the insurer will pay for all injuries in a single accident.

- Coverage Details: Bodily injury liability covers medical expenses, lost wages, legal fees, and pain and suffering for the injured parties when you are at fault.